Things to keep in mind before buying car insurance

In 2026, the process of buying car insurance online in India has evolved into a streamlined, tech-driven experience. However, with the rise of hyper-personalized “Pay-As-You-Drive” models and AI-powered claim settlements, making the right choice requires more than just looking for the lowest premium.

Whether you are insuring a brand-new vehicle or renewing an existing policy, here are the critical factors to keep in mind to ensure your financial safety.

1. Match Coverage to Your Vehicle’s Age

Choosing the right plan is the first step toward a secure drive. In the Indian market, you generally choose between:

- Third-Party Cover: The legal minimum mandated by the Motor Vehicles Act. It covers damages, disability, or death to others. While affordable, it offers zero protection for your own car.

Comprehensive Cover: Highly recommended for new and mid-age cars. It protects against theft, fire, and natural disasters (like floods or cyclones), alongside third-party liabilities.

2. Optimize the Insured Declared Value (IDV)

IDV is the maximum sum insured that the company will pay if your car is stolen or totaled. It is calculated based on the manufacturer’s listed selling price minus depreciation.

The Balance: Setting a low IDV reduces your premium but can leave you with a massive financial gap in case of a total loss. Always aim for an IDV that is closest to your car’s current market value.

3. Evaluate the Claim Settlement Ratio (CSR)

In 2026, an insurer’s reliability is measured by their CSR—the percentage of claims settled against those received.

- The Benchmark: Look for insurers with a CSR consistently above 95%. Also, check for “Self-Video Claims” or AI-based inspection features that can settle minor claims within hours rather than days.

4. Selective Use of Add-On Covers

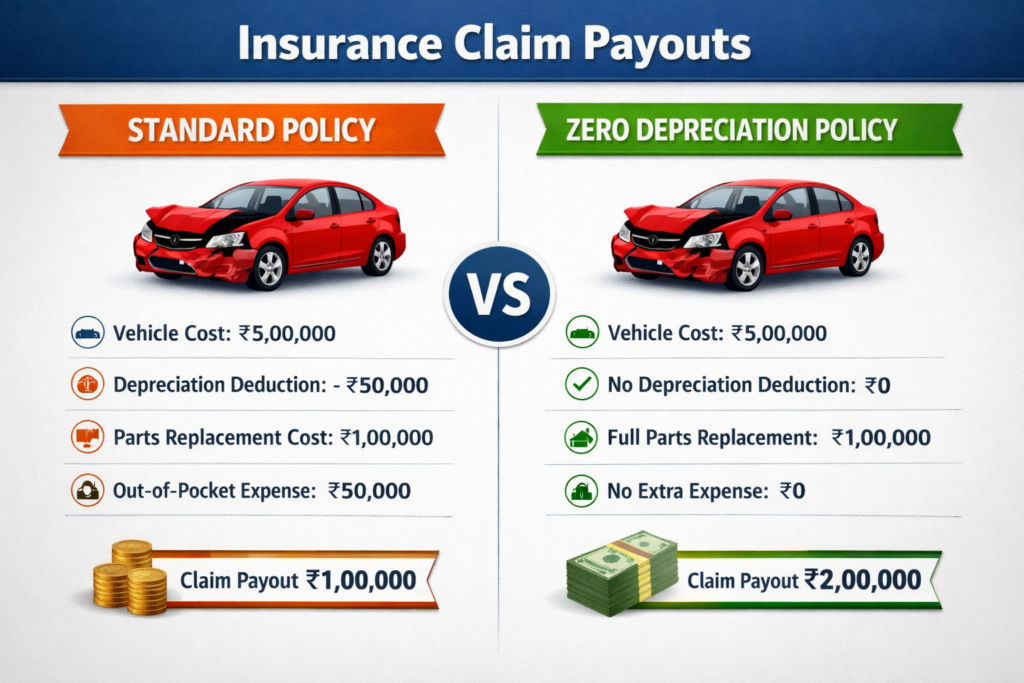

Standard policies have gaps. Customizing your plan with specific “riders” can prevent out-of-pocket expenses:

- Zero Depreciation: Essential for cars up to 5 years old; it ensures the insurer pays for the full cost of replaced parts without deducting for wear and tear.

- Engine Protection: Vital for regions prone to heavy rains, as it covers internal engine damage due to water ingression (hydrostatic lock).

- Return to Invoice (RTI): In the event of theft or total loss, RTI ensures you receive the original invoice value of the car, including registration and taxes.

5. Leverage the No Claim Bonus (NCB)

The NCB is a reward for safe driving, offering discounts ranging from 20% to 50% on your “Own Damage” premium for every claim-free year.

Pro Tip: The NCB is linked to the owner, not the car. If you sell your old car and buy a new one, you can transfer your earned NCB to the new policy to save significantly on your first premium.

6. Consider Usage-Based Insurance (UBI)

A major trend in 2026 is “Pay-As-You-Drive” insurance. If you use your car primarily for short weekend trips or have a low annual mileage, these telematics-based plans can offer up to 15–20% savings compared to traditional annual policies.

Summary Checklist for 2026

Feature | Importance | Why it Matters |

Cashless Garages | High | Minimizes upfront repair costs after an accident. |

Voluntary Deductible | Medium | Increasing this lowers premium, but increases your share of the repair cost. |

Digital Claims | High | Look for mobile-first insurers for faster processing. |

Network Size | High | Ensure your preferred service center is a “network garage.” |

Conclusion

Buying car insurance is no longer a “one-size-fits-all” transaction. By utilizing online comparison tools and focusing on IDV accuracy and claim reliability, you can build a safety net that truly protects your mobility and your assets.

WELFIN INSIGHT

“The right insurance amount is not the cheapest or the highest it’s the one that fits your life.”