Your goals shape our advice. Pick what matters most to you.

Aggressive portfolios for long horizons and surplus money.

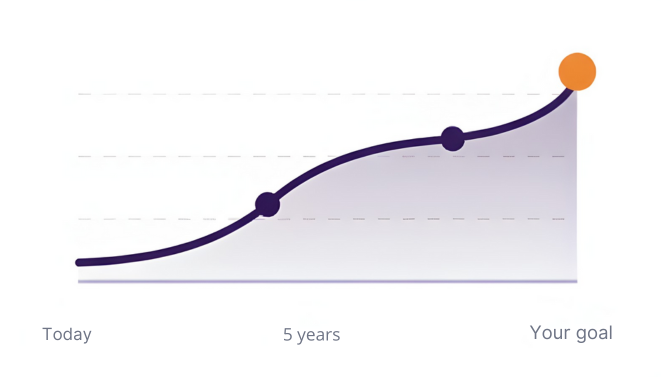

Explore how small monthly investments today can create big returns tomorrow.

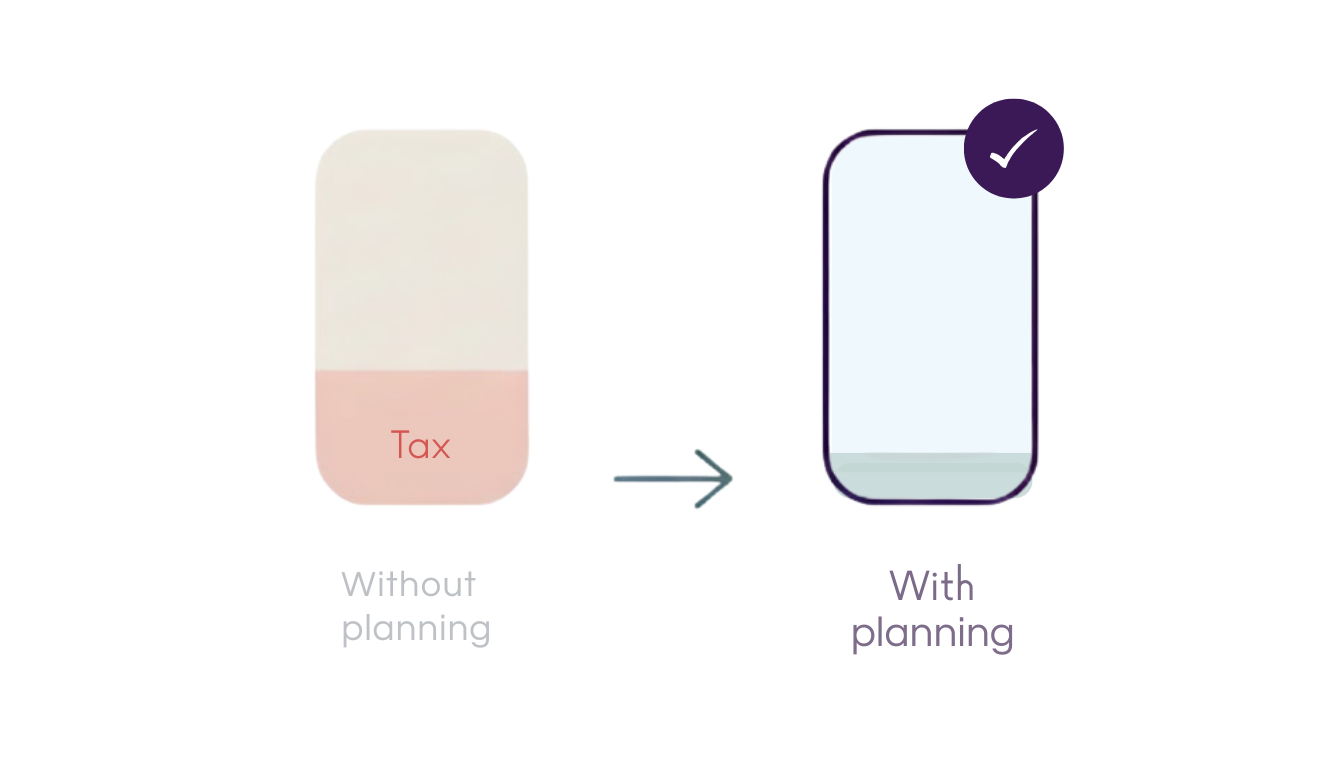

Investments grow your wealth. Insurance protects it. Let’s make sure the foundation is solid.

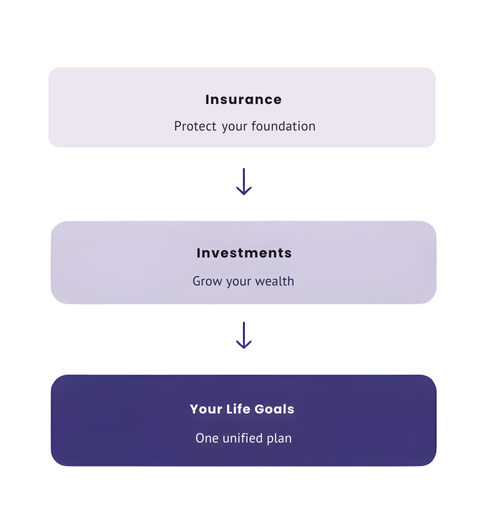

Insurance protects what you have. Investments grow what you save. Our advisory brings them together into one clear plan for your life.

Free consultation · No commitments · Your pace

Mutual Fund Investments are subject to market risks. Read all scheme related documents carefully.