The Role of Mutual Fund Distributors in Wealth Creation

The Role of Mutual Fund Distributors in Wealth Creation In the rapidly evolving financial landscape of 2026, the abundance of investment options can be paralyzing. While mobile apps allow you to buy a fund in seconds, they lack the strategic foresight to tell you which fund fits your life goals or when to exit. This is why the role of a professional has become more vital than ever. Beyond mere transactions, the right partner bridges the gap between simple savings and true, long-term wealth creation. What is a Mutual Fund Distributor? If you are new to investing, you might ask, “What is a mutual fund distributor?” Simply put, they are certified professionals who act as a strategic bridge between Asset Management Companies (AMCs) and investors. Unlike a generic portal, a distributor provides the “human touch”—helping you navigate market volatility and aligning your investments with your personal milestones. How Mutual Fund Distributors Drive Wealth Creation Wealth isn’t built by luck; it is built through discipline and professional oversight. A distributor drives value in three key ways: Risk Profiling: They perform a deep analysis of your “Risk Appetite” versus your “Risk Capacity,” ensuring you don’t over-invest in high-risk small-caps when you actually need the stability of large-cap or hybrid funds. Behavioral Coaching: During market corrections, most “Do-It-Yourself” (DIY) investors panic and sell at the bottom. A distributor acts as an emotional shield, providing the data needed to stay invested and reap long-term rewards. Portfolio Rebalancing: As markets move, your asset allocation shifts naturally. A distributor ensures your portfolio is periodically adjusted to keep your risk levels in check. The Business Side: How They Earn A common question from both investors and aspiring professionals is, “How do mutual fund distributors earn money?” or “How much do mutual fund distributors earn?” Mutual Fund Distributor Commission: Distributors earn a “trail commission” paid by the AMC, not directly by the investor. This commission is built into the Regular Plan of the mutual fund. The Value Proposition: While “Direct Plans” have slightly lower expense ratios, the professional expertise provided by a distributor often results in better long-term “Alpha” (returns above the benchmark), which far outweighs the commission cost over time. For Professionals: How to Become a Mutual Fund Distributor The financial services sector in India is currently in a “Golden Age.” If you are researching how to become a mutual fund distributor, the process in 2026 is highly professionalized: Certification: You must pass the NISM Series V-A: Mutual Fund Distributors Certification Examination. Registration: Once certified, you must register with the Association of Mutual Funds in India (AMFI) to obtain your ARN (AMFI Registration Number). Empanelment: You then empanel yourself with various AMCs to offer their specific funds to your clients. Why Professional Guidance Matters in 2026 In an era of AI-driven market cycles, having a partner who understands the nuance of financial planning is essential. A professional doesn’t just “sell a fund”; they manage a journey. Goal-Based Investing: Strategic planning for specific targets like a child’s education, a dream home, or a peaceful retirement. Transparent Communication: Clear explanations of commission structures and performance metrics. Modern Tech Integration: Utilizing 2026 digital suites to track net worth and goal progress in real-time. In a Nutshell A mutual fund distributor is more than just a middleman; they are a financial coach. Whether you are looking to start your first ₹500 SIP or manage a multi-crore portfolio, the right guidance ensures that your money works as hard as you do. WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 The Role of Mutual Fund Distributors in Wealth Creation Read More January 14, 2026 How Wealth Management Companies in India Adapt to Changing Markets Read More January 14, 2026 Why Life Insurance is More Critical Than Ever Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch

How Wealth Management Companies in India Adapt to Changing Markets

How Wealth Management Companies in India Adapt to Changing Markets In 2026, India’s wealth landscape is undergoing a “Great Wealth Transition.” As the domestic mutual fund industry crosses the $1 trillion AUM mark and a digitally native affluent class takes center stage, traditional “product selling” has been replaced by sophisticated, tech-enabled advisory. As a leading voice in the industry, Welfin explores how the best wealth management companies in India are evolving to navigate this dynamic era. 1. From Product-Centric to “Goal-Centric” Advisory In 2026, top wealth managers have abandoned the “one-size-fits-all” mutual fund pitch. Instead, they use Goal-Based Investing to align portfolios with specific life milestones rather than just chasing generic returns. The Strategy: Portfolio construction works backward from the target. For a child’s education in the UK or a premium property in New Town, managers calculate the required inflation-adjusted corpus and select assets based on that specific time horizon. The Outcome: This prevents emotional “panic-selling” during market dips because investors remain focused on their long-term purpose. 2. The Era of “Agentic AI” and Hyper-Personalization Wealth management has moved beyond simple robo-advisors. In 2026, Agentic AI—AI that can autonomously perform complex financial tasks—is the new standard. Real-time Optimization: AI agents analyze spending, tax brackets, and global sentiment in real-time to suggest immediate shifts. Proactive Rebalancing: Instead of waiting for a quarterly review, AI-driven platforms can trigger a rebalance the moment a market event (like a central bank rate cut) impacts your specific holdings. 3. Democratization of Alternative Investments In 2026, “Alternatives” are no longer exclusive to the ultra-rich. Mass-affluent investors now have access to high-yield assets that were previously out of reach. Fractional Ownership: Through tokenization and Small-Medium REITs (SM REITs), retail investors can now own a “fraction” of a high-growth data center or commercial park with minimal capital. Private Credit & AIFs: Investors are increasingly using Private Credit for stable 12–15% yields, acting as a stabilizer against stock market swings. 4. Navigating Global Market Integration Indian portfolios are now globally synchronized. Wealth managers are helping clients diversify geographically to hedge against a fluctuating Rupee and tap into global innovation. The “Cyborg” Portfolio: Successful investors in 2026 balance India’s domestic growth (Manufacturing/Green Energy) with global exposure to US AI and Semiconductors. Geopolitics as an Asset Class: Managers now actively track global supply chain shifts (the “China+1” strategy) to rotate sectors before they become overcrowded. 5. Emphasis on Tax Alpha and Estate Planning With the complexity of the 2026 Revised Tax Regimes, “Tax Alpha” (the extra return gained from tax efficiency) is a key metric for success. Legacy Building: There is a surge in demand for Family Trusts and succession planning. Wealth managers now act as “Family CFOs,” ensuring that wealth is protected from litigation and passed on with minimal tax leakages. Automated Tax-Loss Harvesting: Systems now scan portfolios daily to offset capital gains with realized losses, a feature that has become standard for the top wealth management companies in India. Why Welfin Ranks Among the Top Wealth Management Companies At Welfin, we believe that while technology handles the what and when, only human wisdom can answer the why. Feature Traditional Wealth Management Welfin’s 2026 Approach Asset Class Equity & FDs Equity, Private Credit, SM REITs & Global Tech Strategy Reactive / Product-Led Proactive / Goal-Based Frequency Quarterly/Annual Reviews 24/7 AI-Monitoring & Real-time Dashboards Legacy Simple Nominee Integrated Family Trusts & Tax Structuring In a Nutshell The market in 2026 rewards the agile and the informed. By choosing a partner that embraces AI-led hyper-personalization, global diversification, and tax-efficient legacy building, you ensure your financial future is not just “planned,” but future-proofed. WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 How Wealth Management Companies in India Adapt to Changing Markets Read More January 14, 2026 The Role of Portfolio Management Companies in Building Long-Term Wealth Read More January 14, 2026 Top 10 Qualities to Look for in a Wealth Management Company Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch

The Role of Portfolio Management Companies in Building Long-Term Wealth

The Role of Portfolio Management Companies in Building Long-Term Wealth By 2026, India’s wealth landscape is being reshaped by what many describe as a “Great Wealth Transition.” With the domestic mutual fund industry nearing the $1 trillion AUM mark and a rapidly growing digitally native affluent class, traditional investment approaches are proving inadequate. Wealth management is evolving into a more structured, data-driven, and client-centric discipline. This shift reflects how portfolio management companies are adapting to the new realities of 2026. 1. From Product-Centric to Goal-Centric Advisory Modern wealth management has moved beyond standardized product recommendations. Instead, advisors increasingly apply goal-based investing, where portfolios are constructed around clearly defined life objectives. How it works Portfolio design begins with the end goal: funding a child’s overseas education, purchasing a second home, or building a retirement corpus. Advisors calculate the inflation-adjusted amount required and select assets based on the investor’s time horizon and risk tolerance. Why it matters A goal-linked structure helps investors remain disciplined during market volatility, reducing the likelihood of emotionally driven decisions such as panic selling. 2. The Era of Agentic AI and Hyper-Personalization By 2026, wealth management has advanced beyond basic robo-advisory models. The industry increasingly relies on agentic AI — systems capable of autonomously analyzing data and executing portfolio tasks. Key developments Hyper-personalization: AI engines continuously evaluate spending patterns, tax positions, life events, and macroeconomic indicators to refine portfolio recommendations. Proactive rebalancing: Instead of periodic reviews, portfolios are now dynamically adjusted in response to market events, policy changes, and geopolitical developments. 3. Democratization of Alternative Investments Alternative assets are no longer limited to institutional or ultra-high-net-worth investors. In 2026, technology has broadened access for mass-affluent investors. Notable trends Private credit and REITs: Investors increasingly allocate to private credit for income stability and to real estate investment trusts for participation in commercial property growth. Fractional ownership: Digital platforms and tokenization allow individuals to invest in infrastructure assets such as logistics parks or data centers with significantly lower capital requirements. 4. Global Integration and Geopolitics as a Portfolio Variable Indian portfolios are becoming more globally diversified, reflecting the need to hedge currency risk and access international growth opportunities. Strategic shifts Cross-border diversification: Investors balance domestic growth sectors with global innovation themes such as artificial intelligence, semiconductors, and renewable technologies. Geopolitical awareness: Portfolio construction increasingly incorporates trade policies, supply-chain realignments, and geopolitical risk as core inputs rather than afterthoughts. 5. Tax Efficiency and Multi-Generational Wealth Planning With the revised tax structures of 2025–26, tax optimization has become a central element of portfolio management. Core focus areas Tax-loss harvesting: Automated systems now identify opportunities to offset gains with realized losses on an ongoing basis. Estate and succession planning: The growing use of family trusts, structured succession frameworks, and comprehensive estate planning ensures continuity of wealth with reduced tax leakage and legal risk. Conclusion The wealth management environment of 2026 rewards informed, adaptive, and disciplined investors. Portfolio management companies are no longer merely product distributors; they function as long-term financial architects, integrating advanced technology, global diversification, behavioral discipline, and tax efficiency into a cohesive wealth strategy. The future of wealth creation lies not in chasing returns, but in building resilient, purpose-driven portfolios designed to endure across market cycles and generations. WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 The Role of Portfolio Management Companies in Building Long-Term Wealth Read More January 14, 2026 Top 10 Qualities to Look for in a Wealth Management Company Read More January 14, 2026 Common first time home buyer Mistakes Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch

Top 10 Qualities to Look for in a Wealth Management Company

Top 10 Qualities to Look for in a Wealth Management Company In the volatile financial landscape of 2026, managing wealth is no longer just about picking the right stocks; it’s about choosing the right strategic partner. With the rise of AI-driven “robo-advisors” and a flood of complex global investment products, the gap between a “standard” firm and a “premier” one has widened significantly. If you are looking for a firm to manage your hard-earned assets, you need more than just a broker. A true wealth management partner should embody these 10 non-negotiable traits. 1. Fiduciary Responsibility A great wealth management firm must act as a fiduciary. This means they are legally and ethically bound to put your interests above their own. They don’t push products because of high commissions; they recommend strategies because they truly fit your long-term objectives. 2. Holistic Financial Planning Wealth management is not a synonym for “investing.” A top-tier firm looks at the “big picture”—including tax optimization, estate management, insurance coverage, and retirement goals. Your bank balance should never be viewed in isolation from your life goals. 3. Transparency in Fee Structure Hidden costs can significantly erode your returns over time. A professional firm is upfront about how they are compensated. Whether they utilize a fee-based model or a commission-based structure, there should be zero “hidden surprises” in your annual statements. 4. A Proactive (Not Reactive) Approach The modern market moves at lightning speed. You shouldn’t have to call your advisor to ask why your portfolio is fluctuating. A great firm monitors global trends and proactively reaches out to you to rebalance your portfolio before volatility impacts your progress. 5. Deep Multi-Market Expertise While wealth management is now global, your tax and legal obligations are often local. You need a firm that understands international markets while remaining experts in the specific tax implications for your residency and local business cycles. 6. Customized Asset Allocation “Cookie-cutter” portfolios are a red flag. A great wealth manager understands that a mid-career business owner has a vastly different risk appetite than a retiree. Look for a company that builds a bespoke portfolio based on your specific risk profile and time horizon. 7. Strong Technological Infrastructure In 2026, you deserve real-time access to your data. A professional wealth management company invests in secure, high-tech platforms that allow you to track your net worth, performance metrics, and tax documents at the touch of a button. 8. Exceptional Communication Skills Financial jargon can be intimidating and often masks a lack of clarity. A great advisor has the ability to simplify complex concepts. If a manager cannot explain an investment strategy in simple terms, they may not have a deep enough grasp of the underlying risk. 9. Stability and Track Record Wealth is built over decades, not days. Look for a firm with a proven track record of navigating both bull and bear markets. Stability in the leadership team is a key indicator that the firm is built for the long haul and won’t vanish during an economic downturn. 10. The “Human Touch” In the age of AI, empathy is the ultimate competitive advantage. While algorithms can crunch numbers, they cannot understand the emotional weight of your financial decisions. A great wealth management company listens to your fears and celebrates your milestones, acting as a human anchor in a digital world. Conclusion Selecting a wealth management firm is one of the most significant decisions you will make for your family’s future. By holding your potential partner to these 10 standards, you ensure that your assets are not just being “managed,” but are being strategically grown and protected. Does your current management strategy check all 10 boxes? WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 Top 10 Qualities to Look for in a Wealth Management Company Read More January 14, 2026 How to Plan Retirement Read More January 14, 2026 Can Financial Planning Help You Retire Early in 2026? Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch

How to Plan Retirement

How to Plan Retirement Retirement is no longer just about reaching the age of 60 and stopping work. In 2026, the concept has shifted toward Financial Independence, where you work because you want to, not because you have to. However, with rising medical costs and inflation in India, a “peaceful retirement” requires more than just a savings account; it requires a precision-engineered plan. 1. Calculate Your “Retirement Number” (Adjusted for 2026) The biggest mistake people make is underestimating how much they will need. A monthly expense of ₹50,000 today could easily exceed ₹1.5 Lakh in 20 years due to inflation. The Welfin Approach: We help you calculate your “Corpus Goal” by factoring in current lifestyle, healthcare inflation (which is higher than general inflation), and life expectancy. We aim for a “4% Withdrawal Rule” strategy, ensuring your principal remains largely untouched. 2. Diversify Beyond the Traditional “Pension.” The days of relying solely on EPF or a government pension are fading. To beat inflation in 2026, your retirement portfolio must be dynamic: Equity Mutual Funds (The Growth Engine): For those 10+ years away from retirement, equities are essential to build the bulk of the corpus. NPS (The Tax-Efficient Shield): The National Pension System offers additional tax benefits and a structured way to build a pension. Debt & Liquid Assets: As you approach retirement, we transition your funds into lower-risk instruments to protect the capital. 3. Account for the ” Healthcare” Factor Healthcare is the largest expense in retirement. With the expansion of world-class medical facilities, costs have also risen. The Strategy: We integrate a robust Health Insurance plan with a high Super Top-up into your retirement plan. This ensures that a single hospital visit doesn’t wipe out years of retirement savings. 4. The Power of “Early Retirement” (FIRE) Many young professionals in Salt Lake and New Town are now aiming for FIRE (Financial Independence, Retire Early). How to achieve it: It requires a high savings rate (30-50% of income) and aggressive investing in early career stages. Welfin provides the roadmap to help you retire by 45 or 50, allowing you to pursue your passions while your money works for you. 5. Estate Planning: Leaving a Legacy A complete retirement plan includes deciding how your wealth will be passed on. In 2026, estate planning (Wills and Trusts) is no longer just for the ultra-wealthy. We help you ensure that your assets are transferred seamlessly to your loved ones without legal hurdles. Why Welfin is Most Trusted Retirement Partner Planning for 30 years without a regular salary is daunting. That’s where the “human touch” of an advisor becomes invaluable. Inflation-Adjusted Planning: We don’t just look at today’s numbers; we look at the purchasing power of your money in 2040 and 2050. Behavioral Coaching: We help you stay the course during market volatility, ensuring you don’t panic-sell your retirement nest egg. Local Expertise: We understand the social and economic fabric of, helping you plan for a retirement that fits your local lifestyle and family needs. In a Nutshell Retirement planning is not a one-time event; it is a journey. The best time to start was yesterday; the second-best time is today. Whether you are 25 or 55, a structured plan from Welfin can ensure that your golden years are truly golden. Don’t leave your future to chance. Secure your freedom today. WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 How to Plan Retirement Read More January 14, 2026 Can Financial Planning Help You Retire Early in 2026? Read More January 14, 2026 5 Tax-Saving Tips in 2026 Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch

5 Tax-Saving Tips in 2026

5 Tax-Saving Tips in 2026 Tax planning is often seen as a year-end chore, but in 2026, it has become a sophisticated part of wealth management. With the shifting landscape between the Old and New Tax Regimes in India, simply “investing in an LIC policy” is no longer enough to optimize your take-home pay. 1. Choose Your Regime Wisely (The 2026 Shift) In 2026, the New Tax Regime became the default for most taxpayers due to its lower slabs and higher standard deductions. However, for many homeowners with active home loans, the Old Regime might still offer better savings. The Strategy: Before April ends, sit down with a Welfin advisor to run a comparative analysis. We calculate your deductions (HRA, 80C, 80D) against the lower rates of the new regime to find your “Break-even Point.” 2. Maximize Section 80D (Health Insurance) With medical inflation rising in 2026, health insurance is both a life necessity and a tax boon. The Tip: You can claim up to ₹25,000 for your own insurance and an additional ₹50,000 if you pay for your senior citizen parents’ health cover. Context: Given the high cost of quality healthcare in the city, this deduction allows you to secure top-tier treatment at hospitals like Apollo or AMRI while reducing your taxable income by up to ₹75,000. 3. Leverage the Power of ELSS (Equity Linked Savings Scheme) If you are sticking with the Old Regime, ELSS remains the most efficient wealth-building tool under Section 80C. The Advantage: It has the shortest lock-in period (3 years) compared to PPF (15 years) or Tax-Saving FDs (5 years). The 2026 Perspective: Beyond saving tax, ELSS allows you to participate in India’s growth story, potentially offering double-digit returns that far outpace inflation. 4. Boost Retirement with NPS (Section 80CCD) The National Pension System (NPS) offers an additional deduction of ₹50,000 over and above the ₹1.5 lakh limit of Section 80C. Why it works: It is one of the lowest-cost investment products in the world. In 2026, with the focus on long-term social security, NPS is an excellent way for young professionals to build a retirement corpus while lowering their tax bracket. 5. Home Loan Interest & HRA Optimization For those living in or buying property, your home is a major tax-saving asset. Section 24(b): You can claim a deduction of up to ₹2 lakh on the interest paid on a home loan for a self-occupied property. HRA + Home Loan: If you are paying rent in one part of the city (like Salt Lake) while your own home is in another (or in a different city), you might be eligible to claim both HRA and home loan interest benefits. Why Welfin is Your Trusted Tax Partner Tax laws in 2026 are more dynamic than ever. A “DIY” approach often leads to missed opportunities or, worse, notices from the IT department. Year-Round Planning: We don’t wait for March. We start your tax planning in April so you can spread your investments through SIPs. Compliance & Growth: Our goal isn’t just to save you tax—it’s to ensure the money you save is invested in high-growth assets. Personalized Audit: We review your salary structure to suggest “Tax-Efficient Restructuring” that you can discuss with your HR. 1. The “Tariff Shock”: A Trade War with Washington The single most significant weight on the Rupee since late 2025 has been the aggressive trade stance adopted by the United States. Following the imposition of punitive 50% tariffs on select Indian goods, particularly those linked to Russian oil processing or high-competition sectors, India’s export engine has struggled. Sectoral Impact: Labor-intensive industries like textiles, handicrafts, gems, and leather have been hit hardest. When these goods become 50% more expensive for American buyers, order volumes plummet. The Dollar Gap: A decline in export earnings means fewer Dollars are entering the country. Simultaneously, India’s demand for Dollars to pay for essential imports (like high-tech machinery and electronics) remains high. This mismatch creates a structural demand for the Greenback, naturally pushing the Rupee lower. 2. The Massive Exodus of Foreign Capital (FII Outflows) If the currency is the “price” of a nation’s assets, then the current price reflects a massive “sell” signal from global investors. In 2025, Foreign Institutional Investors (FIIs) pulled out a staggering ₹1.66 Lakh Crore ($18.9 Billion) from Indian equities. This trend hasn’t stopped with the new year. In the first two trading sessions of January 2026 alone, FIIs offloaded another ₹7,608 Crore. Valuation Concerns: For much of 2025, Indian stocks were trading at high premiums. Global funds shifted capital to other emerging markets or back to the US, where AI-driven growth and high interest rates offered better risk-adjusted returns. The Repatriation Effect: Every time an FII sells a stock on the NSE or BSE, they receive Rupees. To take that money home, they must sell those Rupees to buy Dollars. This constant selling pressure on the INR is a primary reason the ₹90 mark was breached so easily. 3. The RBI’s “Goldilocks” Gamble The Reserve Bank of India (RBI) finds itself in a delicate balancing act. In December 2025, the RBI delivered a “double bonanza”: it cut the repo rate by 25 basis points to 5.25% and injected ₹1.5 Lakh Crore of liquidity into the system. Why the cut? Domestic inflation has cooled to a “Goldilocks” level of 2.0%, giving the RBI room to prioritize growth over currency defense. The Consequence: Lower interest rates make a currency less attractive to “carry trade” investors who borrow in low-interest currencies to invest in high-interest ones. By signaling a more accommodative stance, the RBI has effectively told the market that it is willing to tolerate a weaker Rupee if it helps keep the domestic economy humming. 4. The Rise of the “Safe Haven” Dollar It is important to remember that the Rupee’s weakness is partly a reflection of the US Dollar’s exceptional strength. The US Dollar Index (DXY) currently sits at 98.38, reflecting broad-based demand for the Greenback amidst global

How to plan finance

How to plan finance In the fast-paced economy of 2026, financial planning has shifted from simple “saving” to complex wealth engineering. With shifting tax regimes, the mainstreaming of alternative investments, and the integration of AI in money management, the old methods are no longer enough. 1. The Foundation: Assessing Your “2026 Reality.” Financial planning starts with a snapshot of your current situation. Before you can reach a destination, you must know where you are starting. Cash Flow Audit: Track every rupee. In 2026, the 50/30/20 Rule remains a gold standard: 50% for Needs: Rent, groceries, and essential utilities. 30% for Wants: Dining at Park Street, travel, and lifestyle. 20% for Savings/Debt: SIPs, insurance, and loan repayments. Net Worth Statement: List your assets (savings, gold, property, MF) and subtract your liabilities (home loans, credit card debt). 2. Setting SMART Financial Goals Investing without a goal is like taking a taxi without telling the driver where to go. You’ll spend money but won’t arrive anywhere. Categories of Goals: Goal Type Duration Examples Recommended Assets Short-Term < 3 Years Emergency fund, vacation, car downpayment Liquid funds, FDs, and Arbitrage funds Medium-Term 3–7 Years Wedding expenses, higher education Balanced Advantage funds, Index funds Long-Term 7+ Years Retirement, child’s career, heritage home Equity Mutual Funds, Small-cap/Mid-cap 3. The 2026 Protection Layer (Non-Negotiables) A single medical emergency or an untimely event can derail years of planning. Emergency Fund 2.0: In a volatile 2026 job market, we recommend keeping 6 to 12 months of expenses in a liquid savings account. Term Insurance: A cover of at least 15x your annual income. Health Insurance: Given rising medical inflation in 2026, a base plan of ₹10L with a “Super Top-up” is essential for access to top hospitals like Apollo or AMRI. 4. Modern Asset Allocation In 2026, beating inflation requires more than just Fixed Deposits. Equity Core: 70–80% of long-term wealth should be in Flexi-cap and Large & Mid-cap funds to capture India’s growth. Alternative Satellite: Explore fractional real estate or private credit (crowdfunding) for 5-10% of your portfolio to diversify beyond the stock market. Tax Efficiency: With the updated 2026 tax codes, choosing between the Old and New Tax Regimes requires a custom calculation based on your deductions (80C, 80D, and NPS). Why Welfin is the Best Financial Advisor While AI apps can track your spending, they cannot understand your family’s specific aspirations or the nuances of the local market. Hyper-Customization: We don’t believe in “one-size-fits-all” portfolios. Your plan is as unique as your thumbprint. Objective Advice: As independent advisors, our loyalty is to your goals, not to commissions from any specific insurance or mutual fund company. Behavioral Coaching: We help you stay disciplined during market corrections, preventing emotional “panic-selling” that destroys wealth. Ready to take control of your financial journey? Financial freedom doesn’t happen by chance; it happens by choice. Whether you are a young professional in Salt Lake or a business owner in Burrabazar, Welfin is here to guide you. WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 How to plan finance Read More January 14, 2026 When should you start financial Planning Read More January 14, 2026 Things to Know Before Buying Your Car Insurance for Beginners Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch

Things to Know Before Buying Your Car Insurance for Beginners

Things to Know Before Buying Your Car Insurance for Beginners Buying your first car is an exhilarating experience, but it comes with a steep learning curve, especially when it comes to paperwork. For many, the world of insurance feels like a maze of jargon and hidden costs. However, skipping the details can lead to massive out-of-pocket expenses later. 1. The Legal vs. The Logical: Third-Party vs. Comprehensive As a beginner, you must understand the two main types of coverage: Third-Party Cover: This is the legal minimum required by Indian law. It covers damages caused by your car to others (people or property). It does not cover your own car. Comprehensive Cover: This is what we recommend for every beginner. it covers third-party liability PLUS damages to your own car due to accidents, fire, theft, or natural calamities (like the heavy monsoon flooding often seen). 2. IDV: The “Market Value” of Your Car IDV stands for Insured Declared Value. It is the maximum amount the insurance company will pay if your car is stolen or totally destroyed. Beginner Tip: Don’t set your IDV too low just to reduce your premium. If the car is stolen, you’ll receive a much smaller payout than what the car is actually worth. 3. The Power of “Zero Depreciation.” For new drivers, minor dents and bumper scrapes are common. In a standard policy, the insurer deducts “depreciation” (wear and tear) on parts made of plastic, fiber, and rubber. Why you need it: A Zero-Depreciation add-on ensures the insurer pays the full cost of replaced parts without any deductions. For a beginner, this is the most valuable add-on you can buy. 4. No Claim Bonus (NCB) is Your Reward If you drive safely and don’t make a claim during your policy year, the insurer gives you a discount on your next renewal. This is the No Claim Bonus. It starts at 20% and can go up to 50% over five years. Beginner Tip: Avoid making small claims for tiny scratches. If you pay for small repairs yourself, you save much more in the long run by keeping your NCB discount intact. 5. Cashless Garages in Your City Before buying, check the insurer’s “Network Garages.” You want an insurance company that has tie-ups with reputable workshops (like those in Oodlabari, Salt Lake, or Alipore). The Benefit: At a network garage, the insurer settles the bill directly with the workshop, so you don’t have to pay up front and wait for reimbursement. 6. Don’t Just Buy from the Dealer Most beginners buy whatever insurance the car dealership offers. While convenient, dealers often include high commissions. Welfin Advice: You are not obligated to buy insurance from the car dealer. Comparing plans through an independent advisor like Welfin can often save you 20-30% on your premium while giving you better features. Why Beginners Trust WelfinAt Welfin, we know that your first car is a prized possession. We don’t just give you a policy; we give you a roadmap. Personalized Guidance: We explain the “fine print” so there are no surprises during a claim. Claim Support: If you meet with an accident, you don’t call a robotic toll-free number; you call us. We help you with the documentation and coordination. Local Expertise: We know which insurers have the best service records, specifically in West Bengal. In a Nutshell Car insurance shouldn’t be a “tick-box” exercise. It is your financial shield on the road. By understanding IDV, Zero-Dep, and NCB, you transition from a confused beginner to a smart, protected car owner. Ready to secure your first drive? WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 Things to Know Before Buying Your Car Insurance for Beginners Read More January 14, 2026 What is Financial Planning Read More January 14, 2026 Tips to Reduce Your Motor Insurance Premium Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch

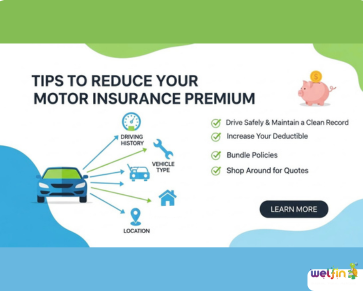

Tips to Reduce Your Motor Insurance Premium

Tips to Reduce Your Motor Insurance Premium Owning a vehicle in a bustling city brings immense convenience, but it also comes with recurring costs. One of the most significant annual expenses is your insurance. While many drivers simply pay the renewal quote they receive, smart vehicle owners know there are several ways to lower that bill without sacrificing protection. As the best motor insurance agency, Welfin is here to help you understand the “hows” and “whys” of your policy so you can keep your premiums low and your coverage high. 1. Understanding the Basics: What is Motor Insurance? Before looking for discounts, it’s important to answer: What is motor insurance? Simply put, motor vehicle insurance is a legal contract that protects you against financial loss in the event of an accident, theft, or third-party liability involving your vehicle. In India, a motor insurance policy is mandatory under the Motor Vehicles Act. However, the type of policy you choose significantly impacts your premium. 2. Choose the Right Type of Cover If you are asking what is comprehensive motor insurance, it is a policy that covers both third-party liability and “Own Damage” (damage to your own vehicle). Tip: If your car is more than 10–12 years old, the market value (IDV) might be so low that a full comprehensive cover isn’t cost-effective. Switching to a standard third-party plan can save you a lot of money, though you bear the risk of your own repairs. 3. Leverage the No Claim Bonus (NCB) The No Claim Bonus is your best friend when trying to reduce your premium. It is a discount given for every year you don’t file a claim. Tip: If you have a minor dent or scratch that costs less to fix than your NCB discount, pay for it out of pocket. Maintaining your NCB can lead to a 50% discount on the “Own Damage” portion of your motor insurance policy over five years. 4. Optimize the Insured Declared Value (IDV) The IDV is the current market value of your vehicle. A higher IDV means a higher premium. Tip: Ensure your IDV is accurate. If it’s set too high, you’re overpaying for a payout you’ll never receive. If it’s too low, you’ll be under-compensated in case of total loss or theft. 5. Install Anti-Theft Devices Insurers love it when you take steps to protect your car. Installing ARAI-approved anti-theft devices can earn you an additional discount on your premium. It shows the motor insurance company that you are a low-risk client. 6. Avoid Small Claims Every time you file a claim, your premium for the next year usually increases because you lose your NCB. Use your insurance for major accidents or total losses, and handle small repairs locally to keep your history clean. How to Check Motor Insurance Online In 2026, transparency is easier than ever. If you want to know how to check motor insurance online, you can visit the official Parivahan (VAHAN) portal or your insurer’s website. By entering your registration number, you can verify your policy expiry date, IDV, and current premium rates. At Welfin, we provide a digital comparison tool that helps you see exactly where you can cut costs across different providers. Why Welfin is the Best Motor Insurance Agency Navigating what is motor insurance policy jargon can be exhausting. At Welfin, we provide personalized consultations to ensure you aren’t over-insured or under-protected. Expert Comparisons: We compare quotes from India’s top insurers to find the lowest premiums. Claim Assistance: We don’t just sell you a policy; we help you navigate the claim process at leading workshops. Renewal Reminders: Never let your policy lapse, which can lead to higher premiums and inspection fees. Your vehicle deserves the best protection at the right price. WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 Tips to Reduce Your Motor Insurance Premium Read More January 14, 2026 Why Do You Need Life Insurance During a Recession? Read More January 14, 2026 Child education Investment Planing India Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch

Why Do You Need Life Insurance During a Recession?

Why Do You Need Life Insurance During a Recession? When the economy takes a downturn, the first instinct for many is to cut expenses. People often look at their monthly outgoings and consider pausing their investment plans or insurance premiums. However, history and financial experts suggest the opposite: A recession is actually the most critical time to hold or even increase your life insurance coverage. As the best insurance advisor, Welfin explains why life insurance isn’t just an expense, but your ultimate financial “shock absorber” during a recession. 1. Protection Against Increased Financial Risk During a recession, job security often decreases, and businesses face unpredictable challenges. If the primary breadwinner were to pass away during an economic slump, the family would not only face emotional loss but also a much harsher financial landscape. The Safety Net: Life insurance provides an immediate tax-free lump sum to your family, ensuring they can maintain their lifestyle, pay off debts, and cover daily costs even when the economy is struggling. 2. Safeguarding Your Debts and Mortgages In an era of fluctuating interest rates and economic instability, many families have ongoing home loans or personal liabilities. Debt Protection: If you were to pass away during a recession, your family might find it impossible to keep up with EMIs. A robust life insurance policy ensures that your home stays with your family, and your debts don’t become their burden. 3. Locking in Lower Premiums Recessions often lead to changes in the insurance industry’s pricing models. The “Lock-in” Advantage: By securing a term life insurance plan now, you lock in a premium based on your current age and health. Even if the economy worsens or inflation rises in the future, your premium remains constant, providing predictable financial planning for years to come. 4. Avoiding the “Wealth Erosion” Trap When markets crash, many people see their savings and investment portfolios (like Mutual Funds or Stocks) shrink. Guaranteed Liquidity: While equity markets are volatile, the death benefit of a life insurance policy is guaranteed. It ensures that your family doesn’t have to sell off assets at a loss (at “recession prices”) to meet their immediate financial needs. 5. Peace of Mind in Uncertain Times The mental toll of a recession is significant. Worrying about “what if” can affect your productivity and health. The Psychological Edge: Knowing that your family’s future is secure regardless of the Sensex or the global economy allows you to focus on navigating the recession with a clear head. Why Consult Welfin During an Economic Downturn? Choosing the right policy during a recession requires a delicate balance between affordability and adequate coverage. As your trusted insurance advisor, Welfin helps you: Analyze Your Human Life Value (HLV): We calculate exactly how much cover you need so you aren’t underinsured. Find Budget-Friendly Options: We compare term plans from India’s top insurers to find high coverage at the lowest possible cost. Policy Audits: If you already have a policy, we check if it is “recession-proof” and aligned with your current liabilities. In a Nutshell A recession is a test of your financial planning. While it may be tempting to save a few rupees by skipping a premium, the risk of leaving your family unprotected during an economic crisis is far too high. Life insurance is the only financial product that guarantees a certain outcome in an uncertain world. Don’t wait for the economy to recover to protect what matters most. [Get a Free Life Insurance Consultation with Welfin Today] WELFIN INSIGHT “The right insurance amount is not the cheapest or the highest it’s the one that fits your life.” January 14, 2026 Why Do You Need Life Insurance During a Recession? Read More January 14, 2026 Child education Investment Planing India Read More January 14, 2026 Financial Planning process in 2026 Read More Confused about money decisions? Get clarity on investments, insurance & goals in one plan. Check Now Not sure if your insurance is enough? 👉 Get a Free Insurance Adequacy Check Get In Touch