10 Common Financial Mistakes First-Time Home Buyers Make & How to Avoid them

Buying your first home is one of life’s biggest milestones, a blend of excitement, pride, and long-awaited independence. But in the rush to turn this dream into reality, many first-time buyers underestimate one crucial element: financial readiness.

According to a Finology report, in the last few years, affordability has worsened sharply. Between 2020 and 2024, property prices in India grew at an average annual rate of 9.3%, while household incomes increased by only 5.4%. The result is a widening affordability gap, one that pushes new buyers to overextend their budgets or compromise on future goals just to own a home sooner.

Most people plan their home purchase emotionally, guided by what they want rather than what they can sustain. But home ownership is not just a milestone; it’s a long-term financial commitment that impacts your cash flow, savings, and lifestyle for decades.

In this article, we’ll cover the most common financial mistakes first-time home buyers make in India, and how to avoid them. Use these insights to balance aspiration with affordability and buy a home without compromising your financial stability.

Mistake #1: Not Defining a Realistic Budget

Most first-time buyers begin with what the bank says they can borrow, not what they can genuinely afford. However, eligibility and affordability are two different concepts.

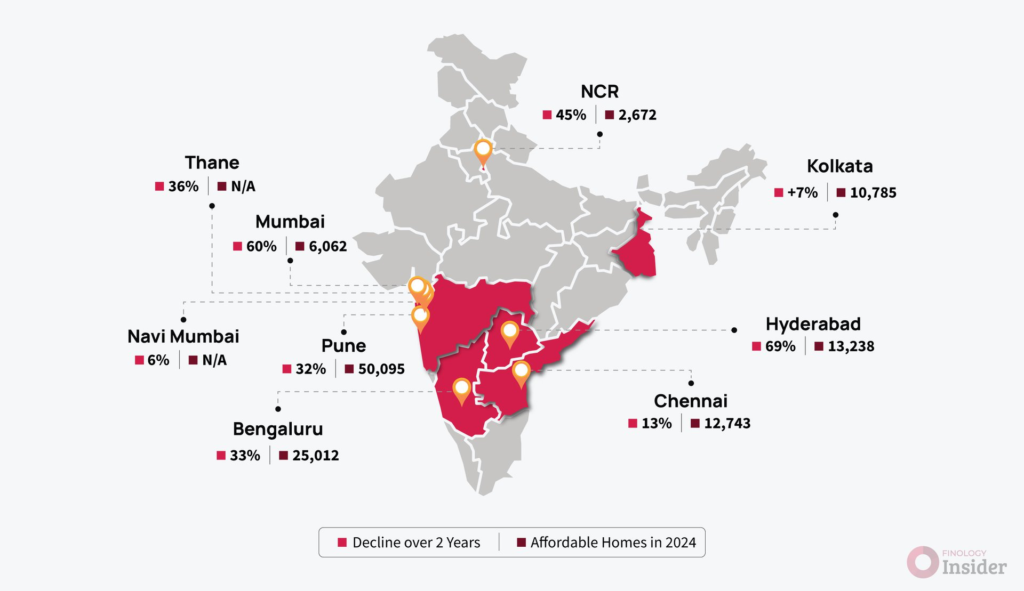

With property prices rising nearly twice as fast as household income, and the number of affordable homes (₹1 crore and below) falling by 36% since 2022, setting a practical budget has never been harder. It’s easy to stretch for a “dream” property today and end up cutting essential savings tomorrow.

Here is the major city wise decline in affordable homes in India.

Source: India’s Affordable Housing Crisis report by Finology

How to avoid it:

- Apply the 4× Annual Income Rule — your total home cost should not exceed four to five times your household’s annual income.

- Example: If your household earns ₹15 lakh a year, your affordable range is ₹60–75 lakh.

- Example: If your household earns ₹15 lakh a year, your affordable range is ₹60–75 lakh.

- Add 8–10 percent to cover hidden costs like stamp duty, registration, interiors, and insurance.

- Use a home-affordability calculator that factors in EMIs, inflation, and future life goals, not just the property price.

A home should fit your financial life comfortably, not control it.

Mistake #2: Ignoring Additional & Hidden Costs

Most buyers calculate only the property price and loan amount and then get caught off guard by the “extras.” In reality, the final cost of ownership can rise by 8–10% once you include mandatory fees and setup expenses.

Beyond the builder’s quote, there are stamp duty and registration charges (5–8%), GST on under-construction properties, brokerage, legal fees, interiors, parking, and even home insurance and maintenance deposits. For a ₹70-lakh property, these add-ons alone can easily push the total cost to ₹77–78 lakh.

How to avoid it:

- Always plan with a 10% cost buffer in your budget.

- Prepare a Total Cost of Ownership (TCO) list before you finalize any property.

- Don’t drain your emergency or short-term funds for these expenses; treat them as part of the project cost from day one.

Ignoring these “small” expenses is how many first-time buyers start their home journey already in financial stress.

Mistake #3: Not Planning the Down Payment Early

Most first-time buyers focus on the loan, not the lump sum needed upfront. But banks usually finance only 75–80% of the property value, leaving you to arrange the remaining 20–25% and that too often at short notice.

Without advance planning, this down payment ends up coming from emergency savings, personal loans, or by redeeming long-term investments, moves that can derail your entire financial plan.

At Welfin, we often advise our clients to start a goal-based SIP three to five years before the purchase. This helps clients build their down payment corpus systematically, without disturbing long-term goals like retirement or education planning.

We have made a dedicated article on financial planning to buy your first home in India, in which we have explained in detail how to calculate the actual cost of your dream home in future value and how to plan your investment for the home down payment. Take a look at it to get a better idea.

How to avoid it:

- Start a goal-based SIP dedicated to your home down payment, investing in short-duration or hybrid funds.

- Align your investment horizon with your home-buying timeline — for example, 3–5 years.

- Avoid touching your emergency fund or long-term assets like PPF or NPS.

The earlier you begin, the smaller the financial burden feels when the opportunity finally arrives.

Mistake #4: Not Checking Credit Score or Loan Readiness

Your home loan approval and the interest rate you get depend heavily on your credit score. Yet, most first-time buyers check it only after applying for a loan, when it’s too late to fix issues.

A CIBIL score below 700 can reduce your eligibility or increase your interest rate by 0.5–1%, costing lakhs over time. Even small factors like high credit card utilization, missed EMIs, or too many loan applications can hurt your score.

How to avoid it:

- Check your credit score at least 6–12 months before applying for a home loan.

- Keep your credit utilization ratio below 30% and clear outstanding credit card dues.

- Avoid applying for multiple loans or cards close to your home loan application.

- Use free monthly reports from CIBIL or Experian on apps like Google Pay or Paytm to track your credit health.

A strong credit score not only improves your loan approval chances but can also save you several lakh rupees over your loan’s lifetime.

Mistake #5: Stretching EMIs Beyond 35–40% of Income

Many first-time home buyers assume that if the bank is willing to lend more, they can afford it. But banks calculate eligibility, not long-term affordability.

According to Finology data, the average EMI-to-income ratio in India has surged to 61% in 2024, up from 46% in 2020. This means that for many families, more than half of their monthly income already goes toward EMIs, leaving little room for savings or emergencies.

Financial planners follow the 28/36 Rule to prevent over-leverage:

- Your home EMI should not exceed 28% of your monthly income.

- Your total EMIs (all loans combined) should not exceed 36%.

Example:

| Monthly Income | Safe EMI (28%) | Risky EMI (61%) |

| ₹1,00,000 | ₹28,000 | ₹61,000 |

At ₹61,000 per month, one job loss, medical emergency, or rate hike can disrupt your finances instantly.

How to avoid it:

- Calculate EMIs assuming at least a 1–2% rise in loan interest over time.

- Prioritize a balanced lifestyle. Home ownership should not come at the cost of financial peace.

- Choose a slightly smaller home today if it means staying stress-free tomorrow.

Mistake #6: Ignoring Future Income and Expense Changes

A home loan is a long commitment, often 15 to 25 years. But most buyers plan EMIs based only on their current salary and expenses. Life doesn’t stay constant that long.

Career breaks, business shifts, higher living costs, or family milestones like children’s education can all strain your finances. Many first-time buyers overestimate future income growth and underestimate upcoming expenses, a dangerous mix when EMIs already take up a big share of their income.

How to avoid it:

- Conduct a simple cash flow stress test — simulate what happens if your income drops by 20% or expenses rise by 20%.

- Avoid assuming annual salary hikes will automatically make EMIs easier to manage.

- Keep 10–15% of your monthly income free after all EMIs and essentials for future flexibility.

- Revisit your affordability every year until the purchase, not just once at loan approval.

Financial planning isn’t about buying the biggest home you can afford today; it’s about ensuring you can keep it comfortably tomorrow.

Mistake #7: Skipping an Emergency Fund Before Buying

In the excitement of buying a home, many first-time buyers forget one essential rule: “never buy property without an emergency fund.”

A job loss, medical emergency, or market downturn can make even regular EMIs feel impossible. Without a safety net, one unexpected event can force you to default or liquidate long-term investments at the worst possible time.

As financial planners, we recommend keeping at least 6–9 months of household expenses before committing to a home loan. This buffer acts as your shock absorber against income gaps or sudden costs.

How to avoid it:

- Build your emergency fund before applying for the home loan.

- Keep it in liquid or ultra-short-term mutual funds for easy access without market risk.

- Refill it immediately after any withdrawal.

Your emergency fund is not money you invest; it’s money that protects everything else you’ve invested.

Mistake #8: Not Comparing Loan Options and Interest Types

Many first-time home buyers simply go with their salary bank or the first lender who approves their loan. But even a 0.25% difference in rate can cost you ₹2–3 lakh over a 20-year tenure, a cost too large to ignore.

There are different types of loans — fixed-rate, floating-rate, and EBLR (External Benchmark Linked Rate) loans (usually linked to the RBI’s repo rate). Some older loans still run on the MCLR (Marginal Cost of Funds-Based Lending Rate) system. Each type reacts differently to interest rate changes, and choosing the wrong one can make EMIs unpredictable.

Which type of interest rate is better for a home loan?

- EBLR (repo-linked) loans are now the most common and transparent. When the RBI cuts or raises the repo rate, your loan rate changes accordingly, usually within three months. It’s ideal for those who are comfortable with small fluctuations and who want faster rate benefits when markets ease.

- Fixed-rate loans offer stability, and your EMI stays constant even if rates rise. However, they start at a slightly higher rate and are better suited for buyers who prefer predictability over flexibility.

- MCLR loans are older and slower to adjust. If your loan still follows MCLR, consider switching to an EBLR-linked plan for quicker transmission of rate cuts.

How to avoid mistakes:

- Compare offers from at least three banks or HFCs, not just your salary bank.

- Check the Annual Percentage Rate (APR), which includes hidden costs like processing and admin fees.

- Understand the rate reset frequency, how often your interest is reviewed under floating/EBLR loans.

- Negotiate processing fees or bundled insurance premiums; lenders often have room to adjust.

Choosing the right loan isn’t just about getting the lowest rate; it’s about ensuring your EMI stays affordable throughout changing market cycles.

Mistake #9: Using All Savings for Down Payment

Many first-time home buyers pour every rupee of their savings into the down payment just to reduce the loan amount. While it feels smart initially, it often leaves them with no liquidity for emergencies, interiors, or basic moving expenses.

A home loan is a long-term commitment. If you use up all your savings now, you’ll have nothing to fall back on when life throws a surprise. In the worst cases, buyers end up taking high-interest personal loans soon after getting a low-interest home loan, defeating the purpose.

How to avoid it:

- Keep at least 10–15% of your property value as a post-purchase liquidity buffer.

- Split your savings into parts for the down payment, an emergency fund, and setup costs.

- Avoid touching long-term or goal-based investments (like retirement or child education funds).

- Rebuild your savings plan immediately after the purchase to restore financial balance.

Mistake #10: Treating Property as the Only Investment

Many first-time buyers believe owning a home is the ultimate investment. While property is a valuable asset, it’s also illiquid and concentrated, meaning your wealth gets locked into one place and depends heavily on market cycles.

Real estate prices don’t always move in a straight line, and maintenance, taxes, and loan interest reduce real returns. When your home becomes your biggest (or only) asset, it limits your ability to invest in other growth opportunities like equity, debt, or gold.

We even made dedicated posts on the types of financial planning that you should do to tackle every goal or milestone of your life. Take a look at the article to know how to handle each type of goal and financial planning related to it.

How to avoid it:

- Treat your home as a life goal, not your primary investment strategy.

- Build a diversified portfolio that has a perfect balance between real estate, equity mutual funds, fixed income, and gold.

- Don’t stop your SIPs after taking a home loan; instead, scale them based on your cash flow.

- Review your asset allocation every year to ensure your wealth is growing in more than one direction

Conclusion — Buy Emotionally, Plan Financially

Buying your first home is an emotional decision, but keeping it should be a financial one.

The difference between a comfortable homeowner and a stressed borrower often lies in planning, not property prices.

Each of these mistakes is avoidable with simple, proactive steps: setting a clear budget, preparing for hidden costs, maintaining liquidity, and planning EMIs within your comfort zone. The goal isn’t just to own a house; it’s to do it without compromising your financial stability.

If you’re planning to buy a home soon, take time to understand your numbers first.

Read our detailed guide on Financial Planning for Buying a Home in India and create a roadmap that aligns your dream home with long-term financial peace.