Portfolio management service (PMS) is a customised solution for high net-worth individuals (HNIs), it offers greater flexibility with an investor’s money and higher returns too.

So if you have a substantial amount you want to invest, such as, say a crore, this service can prove beneficial. It is a tailor made professional service offered to cater to the investment objective of different investor classes.

The Investment solutions cater to a niche segment of clients. The clients can be Individuals or institutions with high net worth. In simple words, a portfolio management service provides professional management of your investments to create wealth.

Makes Right Investment Choice :

Portfolio management is a tool that helps the investor in choosing the right portfolio of assets. It enables to make more informed decisions regarding investment plans in accordance with the goals and objectives.

Maximizes Return :

Maximizing the return is one of the important roles played by portfolio investment. It provides a structured framework for analysis and selecting the best class of assets. Investors are able to earn high returns with limited funds.

Avoids Disaster :

Portfolio management avoids the disaster of facing huge risks by investors. It guides in investing among different classes of assets instead of investing only in one type of asset. If an investor invests in only one type of security and supposes it fails, then the investor will suffer huge losses which could be avoided if he might have invested among different assets.

Track Performance :

Portfolio management helps management in tracking the performance of their portfolio of investments. A consolidated investment held within the portfolio can be evaluated in a better way and any of its failures can be easily detected.

Manages Liquidity :

Portfolio management enables investors in arranging their investment in a systematic manner. Investors can choose assets in such a pattern where they can sell some of them easily whenever they need funds.

Avoids Risk :

Investment in securities is quite risky due to the volatility of the security market which increases the chance of losses. Portfolio management helps in reducing the risk through diversification of risk among large peoples.

Improves Financial Understanding :

It helps in improving the financial knowledge of investors. While managing their portfolio they came across numerous financial concepts and learn how a financial market works which will enhance the overall financial understanding.

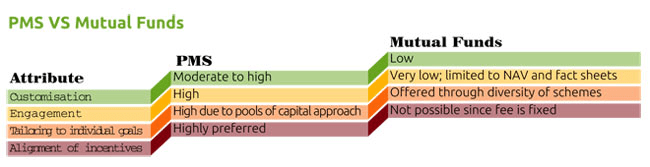

Welfin deals with some of the biggest names in customised tailor-made investing solutions for high net-worth individuals (HNIs), that offer greater flexibility and higher returns. With both Equity and Debt options, the ticket size starts from 50 lac and upwards. Unlike mutual fund managers, PMS Managers are directly accountable to the client, who can seek clarifications, especially in the discretionary portfolio. While many PMS providers offer standardized portfolios, some offer investments tailored to clients’ goals that may want to invest a large amount in a single stock, the only way to hold a big stake in a company if it is a very good investment.